Explore the crucial aspects of flood insurance on the Outer Banks

Flood insurance is an essential consideration for residents of coastal areas, particularly in regions like the Outer Banks. This article aims to provide a comprehensive understanding of flood insurance in this unique geographic location, discussing its importance, options available, and how to effectively manage and acquire it.

The Outer Banks, a series of barrier islands off the coast of North Carolina, are renowned for their beauty but also known for their vulnerability to flooding. This area faces frequent storms and hurricanes, making flood insurance a necessity for some homeowners and businesses alike.

The Outer Banks are divided into various flood zones, each with specific risk levels. Understanding these zones is crucial for residents as they directly impact insurance policies and premiums.

What is a flood map?

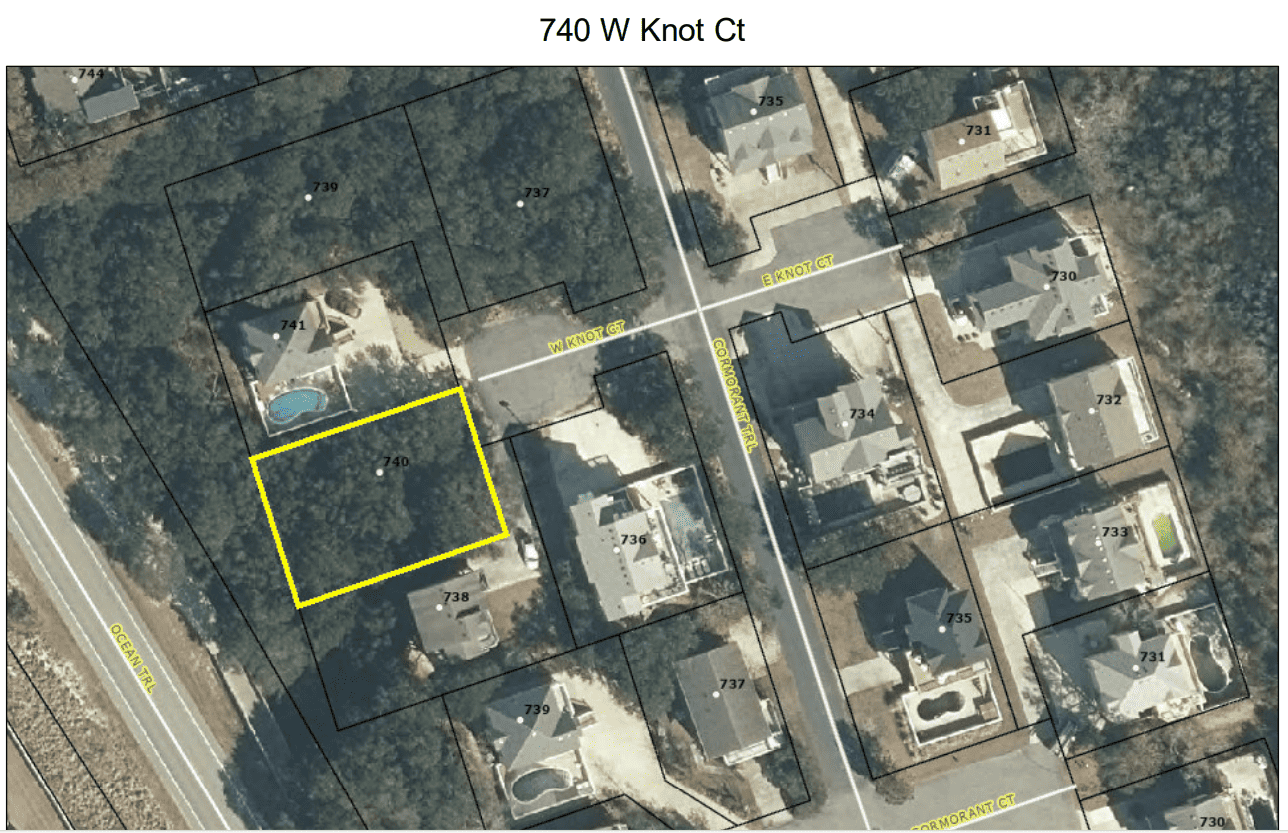

Flood maps show a community’s risk of flooding. Specifically, flood maps show a community’s flood zone, floodplain boundaries, and base flood elevation.

Property owners, insurance agents, and lenders can use flood maps to determine flood insurance requirements and policy costs.

With NFIP’s pricing approach, Risk Rating 2.0, FEMA addresses rating disparities by incorporating more flood risk variables like flood frequency, multiple flood types — river overflow, storm surge, coastal erosion, and heavy rainfall — and distance to a water source, as well as property characteristics such as elevation and the cost to rebuild.

Because your flood risk changes over time, the National Flood Insurance Program (NFIP) and the Federal Emergency Management Agency (FEMA) work with communities across the country to identify and map flood risk on an ongoing basis.

Flood mapping data will still be necessary and essential for communities because of the important role that the Special Flood Hazard Areas (SFHA) serves for NFIP participating communities.

Additionally, Flood Insurance Rate Maps (FIRMs) will continue to be used for mandatory purchase requirements, building code requirements, and floodplain management requirements, as they have always been the backbone of those programs, but will no longer be the most significant factor.

What are the moderate- to low-risk & high risk flood zones?

- Moderate- to low-risk flood areas are designated with the letters B, C, and X on FEMA flood maps. In these areas, the risk of being flooded is reduced, but not completely removed. One in three insurance claims come from moderate- to low-risk flood areas.

- High-risk flood areas begin with the letters A or V on FEMA flood maps. These areas face the highest risk of flooding. If you own a property in a high-risk zone and have a federally backed mortgage, you are required to purchase flood insurance as a condition of that loan.

With unpredictable weather patterns and the potential for devastating natural disasters, flood insurance offers a layer of financial security. It provides a safety net, ensuring that residents can recover and rebuild in the aftermath of a flood. Residents have the option to choose between public programs like the National Flood Insurance Program (NFIP) and private insurance providers. Each option has its benefits and drawbacks. The cost of flood insurance in this region varies based on several factors, including location, property value, and flood risk. Typically, the premiums run from approximately $700-$1200 annually for policies in the X & AE flood zones. Policies in the VE or Cobra zones can run much higher. The majority of the properties on the Outer Banks are located in the X & AE flood zones. To learn more about flood insurance on the Outer banks contact a local insurance provider who can give you policy quotes and explain coverage.

Since 2003 Matt Huband-Broker/Owner of OBX Realty Group has ranked in the top 7% of all Realtors on the Outer Banks in totals sales and sales volume. With his years of experience and extensive area knowledge Matt can help you find the right property on the Outer Banks of NC. To learn more about buying real estate on the Outer Banks contact Matt today.

Current Real Estate Listings: